|

Home >

Settings >

Archives >

May 2021 >

GeoWorks’ GeoTech Shares Fundraising Tips

GeoWorks’ GeoTech Shares Fundraising Tips

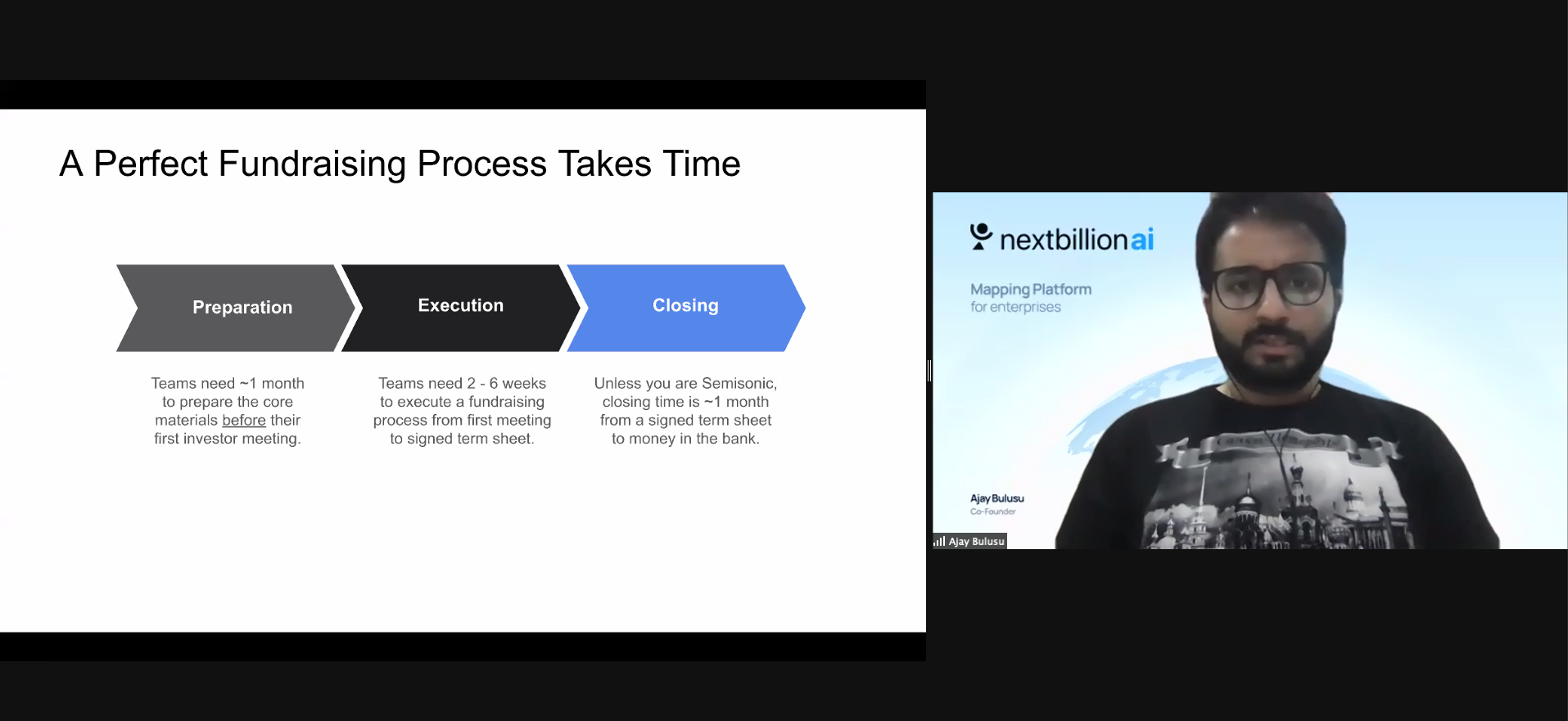

Ajay Bulusu, co-founder of NextBillion.ai

Ajay Bulusu, co-founder of NextBillion.ai

Ajay Bulusu, the co-founder of NextBillion.ai, a GeoWorks’ GeoTech, shared his fundraising experiences and gave a brief on fundraising 101 at a recent webinar, “Understanding Venture Financing & Investment”. The session, held on the 4th of May, was organised by Action Community for Entrepreneurship (ACE), in collaboration with GeoWorks. The hour-long session, which was the second part of ACE’s Teh Tarik Series, was split into two segments – a sharing of fundraising experiences and a live pitching session.

During the first part of the session, Mr Bulusu said that “perfect fundraising takes some time” and that the “end-to-end process would take at least four months”. The fundraising process, he said, involves preparation, execution and closing. Teams require about a month to prepare their core materials before their first investor meeting. In the area of execution, he said that teams need about two to six weeks to executive a fundraising process from the first meeting to the signed term sheet. For closing, it takes about a month from signed term sheet to receiving funds.

Mr Bulusu said that it is important to consider the time that one embarks on fundraising activities, including seasons and quarter ends. “Seasonality is important. It depends where you’re raising. It makes no sense to approach Chinese VCs during Chinese New Year because everyone’s off,” he said.

Mr Bulusu also recommended factoring in “equity plus debt runway”. “It’s very important for you to have at least one year of runway to hit the market. Anything less than one year, you’re treading on very thin ice,” he said.

Mr Bulusu added that preparation is critical and that it includes preparing a target investor list, pitch deck, data deck, data room for legal and financial diligence and customer and management references. He recommended five Ps for perfect fundraising activities and these include the preparation of materials, practising one’s pitch, having precise targets and having patience. “You need to be very patient. It is a super long process. So please don’t get deterred. It’s an emotional cycle but it’s all worth it at the end,” he said.

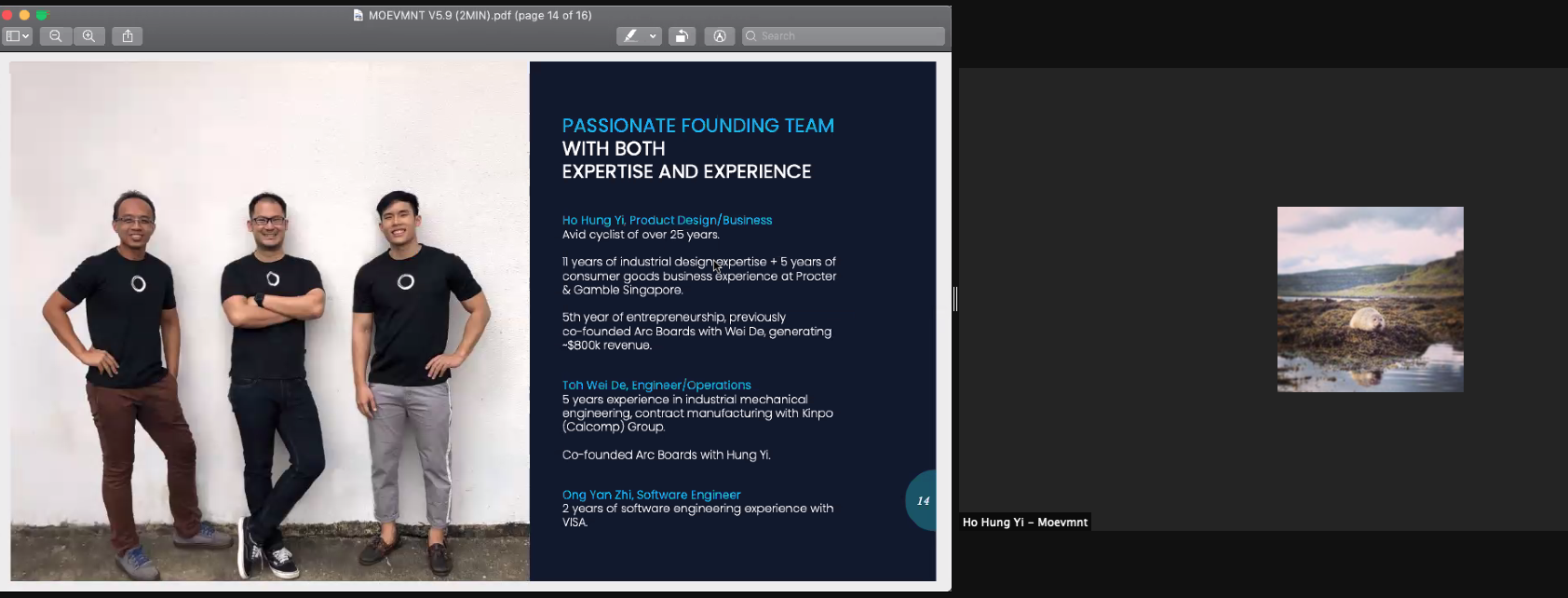

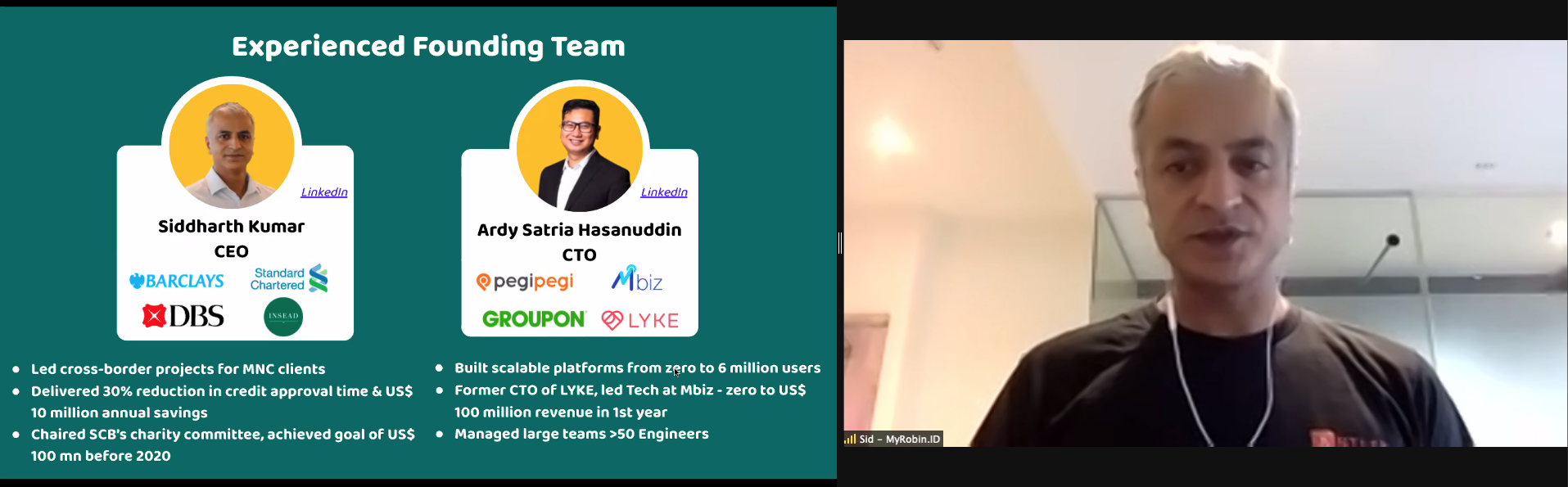

Five companies - Moevmnt Pte Ltd, Trabble (Trippening Pte Ltd), V360Property (Singapore) Pte Ltd, ELXR and MyRobin.ID - participated in a live pitching session during the second part of the webinar. The companies pitched their products and services to a panel of venture capitalist firms - Elev8.vc, Cocoon Capital and Monk’s Hill Ventures.

Companies that pitched their products and services Moevmnt Pte Ltd

|

V360Property

|

Trabble (Trippening Pte Ltd)

|

MyRobin.ID

|

ELXR

|

Panel of representatives from venture capital firms

|

|

|

| From left to right: Eunice Wong (Monk's Hill Ventures), Remi Choon (Elev8.vc) and Zong Xi Sia (Cocoon Capital). |

||